🎮 Level Up with $RESOLV Airdrop!

💎 Grab your free $RESOLV tokens — no quests, just rewards!

🕹️ Register and claim within a month. It’s your bonus round!

🎯 No risk, just your shot at building crypto riches!

🎉 Early birds win the most — join the drop before it's game over!

🧩 Simple, fun, and potentially very profitable.

- Ultra-Fast Solana Profits: Your 1-Minute Bybit Spot Trading Blueprint

- Why Trade Solana on Bybit’s Spot Market?

- Decoding the 1-Minute Timeframe: Speed Is Everything

- Core Elements of a Winning 1-Minute SOL Strategy

- Step-by-Step 1-Minute SOL Trading Strategy

- Non-Negotiable Risk Management Rules

- Essential Tools for 1-Minute Dominance

- Critical Pitfalls to Avoid

- 1-Minute SOL Trading FAQ

- Q: Can I automate this strategy on Bybit?

- Q: What’s the optimal session time for 1-minute SOL trades?

- Q: How do I backtest this strategy?

- Q: Where can I get the PDF strategy checklist?

- Q: Is leverage used in spot trading?

- Final Thoughts: Precision Over Greed

Ultra-Fast Solana Profits: Your 1-Minute Bybit Spot Trading Blueprint

Spot trading Solana (SOL) on Bybit’s lightning-fast platform using 1-minute charts offers explosive profit potential – but demands razor-sharp strategy. This guide delivers a battle-tested approach to navigating SOL’s volatility on micro-timeframes, complete with actionable steps, risk management protocols, and a downloadable PDF strategy checklist. Master the art of capitalizing on SOL’s price spikes and dips with precision timing.

Why Trade Solana on Bybit’s Spot Market?

Bybit provides distinct advantages for SOL traders: ultra-low 0.1% spot fees, deep liquidity ensuring minimal slippage even on 1-minute trades, and a robust interface with real-time charting tools. SOL’s inherent volatility – often swinging 2-5% within minutes during active sessions – creates prime conditions for scalping strategies when paired with Bybit’s execution speed.

Decoding the 1-Minute Timeframe: Speed Is Everything

Trading on 1-minute charts means each candle represents 60 seconds of price action. This micro-view demands:

- Hyper-Vigilance: Constant screen focus to catch fleeting opportunities

- Lightning Decisions: Entries/exits measured in seconds, not hours

- Reduced Profit Targets: Aim for 0.5%-1.5% gains per trade consistently

- High Frequency: 10-30+ trades per session to compound small wins

Core Elements of a Winning 1-Minute SOL Strategy

Build your strategy on these non-negotiable pillars:

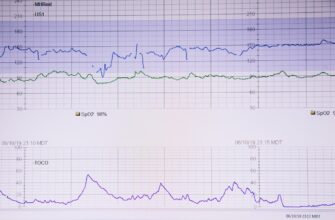

- EMA Ribbon Confirmation: Use 5, 9, and 20 EMAs – enter only when aligned (e.g., all sloping upward for longs)

- RSI Divergence Signals: Spot hidden reversals when price makes new highs/lows but RSI doesn’t confirm

- Volume Spikes: Filter trades with 150%+ average volume candles for confirmation

- Key Level Reaction: Trade bounces/rejections at psychological prices ($20, $25) or VWAP

Step-by-Step 1-Minute SOL Trading Strategy

- Setup: Apply 5 EMA (blue), 9 EMA (yellow), 20 EMA (red) + RSI (14 period) on Bybit chart

- Entry Trigger: Wait for EMA ribbon squeeze (all 3 EMAs within 0.3% price range) followed by:

- Bullish: Green candle closing above all EMAs + RSI > 55

- Bearish: Red candle closing below all EMAs + RSI < 45

- Execution: Enter market order immediately on next candle open

- Profit Taking: Set limit order at 0.8% profit OR next major S/R level

- Stop Loss: Mandatory 0.5% stop below/above entry candle’s low/high

Non-Negotiable Risk Management Rules

- Never risk >1% of capital on any single trade

- Stop trading after 3 consecutive losses

- Avoid trading during SOL network upgrades or Binance SOL futures funding rate >0.1%

- Use Bybit’s “Reduce-Only” orders when closing positions

Essential Tools for 1-Minute Dominance

- Bybit TradingView Integration: Customize charts with EMA/RSI templates

- Coinalyze: Track real-time SOL liquidation heatmaps

- TradeZella: Analyze trade journal metrics (win rate, risk/reward)

- TokenMetrics: Monitor SOL on-chain flows for breakout clues

Critical Pitfalls to Avoid

- Chasing pumps/dumps without EMA confirmation

- Overtrading during low volatility (under 1% hourly range)

- Ignoring BTC correlation – SOL often mirrors Bitcoin on 1-minute charts

- Letting losers run beyond 0.5% stop loss

1-Minute SOL Trading FAQ

Q: Can I automate this strategy on Bybit?

A: Bybit doesn’t support native bots for spot, but API connections to third-party platforms like 3Commas allow partial automation of entry/exit rules.

Q: What’s the optimal session time for 1-minute SOL trades?

A: Overlap of US/EU markets (13:00-17:00 UTC) sees highest volatility. Avoid Asian session lulls.

Q: How do I backtest this strategy?

A: Use TradingView’s replay mode on historical 1-minute SOL/USDT data. Test at least 300 trades for statistical significance.

Q: Where can I get the PDF strategy checklist?

A: Download our optimized 1-minute SOL checklist PDF with entry/exit criteria and risk parameters for quick reference.

Q: Is leverage used in spot trading?

A: No – spot trading on Bybit involves direct asset purchase without leverage. This strategy uses 1:1 capital only.

Final Thoughts: Precision Over Greed

Mastering 1-minute SOL trading on Bybit requires robotic discipline. Focus on executing 20 high-probability 0.8-1% trades daily rather than hunting home runs. Remember: In scalping, consistency trumps magnitude. Download the PDF checklist, paper trade for 72 hours, and only deploy capital when your win rate exceeds 65% in simulations. Solana’s volatility is your ally – but only if you tame it with structure.

🎮 Level Up with $RESOLV Airdrop!

💎 Grab your free $RESOLV tokens — no quests, just rewards!

🕹️ Register and claim within a month. It’s your bonus round!

🎯 No risk, just your shot at building crypto riches!

🎉 Early birds win the most — join the drop before it's game over!

🧩 Simple, fun, and potentially very profitable.